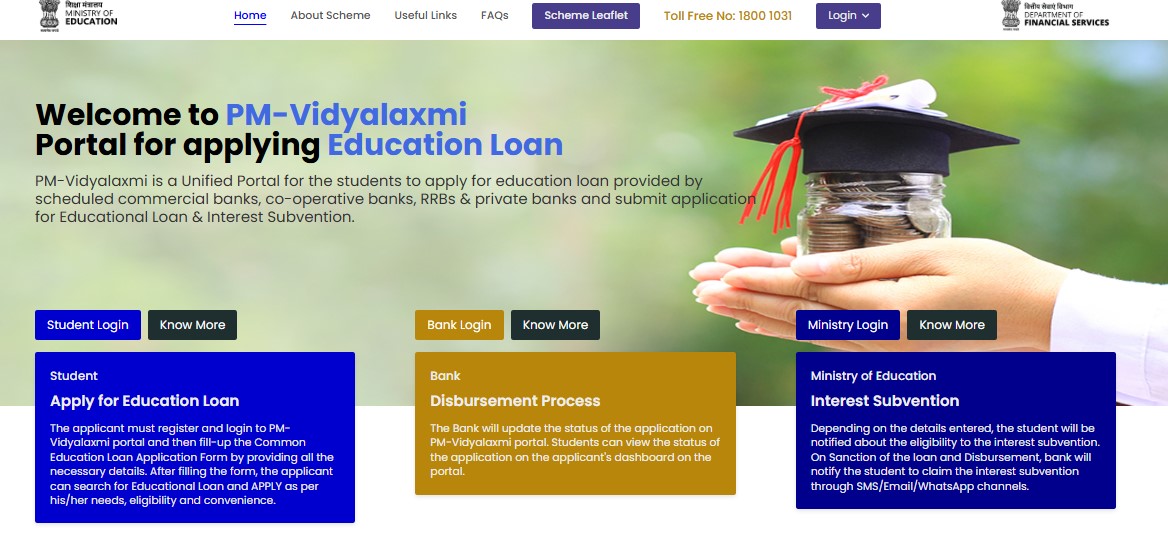

Administered by the Department of Higher Education, Ministry of Education, through the PM Vidyalaxmi portal, it offers a transparent, digital platform for loan applications, interest subsidies, and credit guarantees, particularly benefiting economically weaker sections. This article provides Indian students with a clear, chronological overview of the scheme’s objectives, eligibility, benefits, application process, and more.

Objectives of the PM Vidyalaxmi Scheme

The primary goal of the PM Vidyalaxmi Scheme is to remove financial barriers to higher education and empower meritorious students to pursue their academic dreams. Key objectives include:

- Providing collateral-free and guarantor-free education loans to cover full tuition fees and related expenses.

- Offering interest subsidies for students from lower-income families to reduce the repayment burden.

- Supporting banks with a 75% credit guarantee for loans up to ₹7.5 lakh to encourage lending.

- Ensuring a transparent, digital, and student-friendly application process via the PM Vidyalaxmi portal.

- Aligning with NEP 2020 to universalize access to quality higher education in India.

Eligibility Criteria for PM Vidyalaxmi Scheme

The scheme is designed to be inclusive, targeting students admitted to top-tier institutions. Here’s who can apply:

1. Nationality: Must be an Indian citizen.

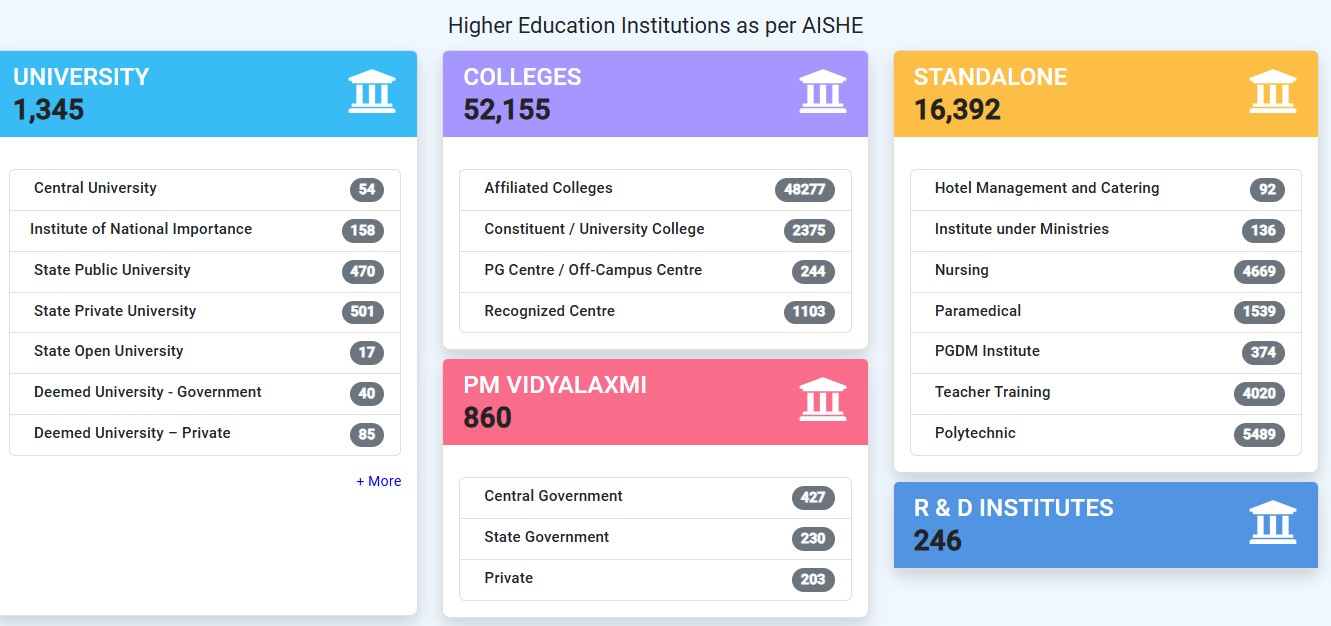

2. Institution: Students must secure admission through merit-based processes or open competitive examinations in the top 860 QHEIs, which include:

- All government and private Higher Education Institutions (HEIs) ranked within the top 100 in NIRF (overall, category-specific, or domain-specific rankings).

- State government HEIs ranked between 101-200 in NIRF.

- All central government-governed institutions.

3. Courses: Applicable for undergraduate, postgraduate, and professional courses (e.g., engineering, medicine, management) in eligible QHEIs.

4. Income Criteria for Interest Subsidy: Students from families with an annual income of up to ₹8 lakh are eligible for a 3% interest subvention on loans up to ₹10 lakh during the moratorium period (course duration plus one year).

5. Exclusions: Students receiving other Central/State Government scholarships, interest subventions, or fee reimbursements are not eligible. Additionally, students dismissed from institutions on academic or disciplinary grounds or those who discontinue their studies are ineligible for interest subsidies or credit guarantees.

Benefits of the PM Vidyalaxmi Scheme

The scheme offers a range of financial benefits to make higher education affordable:

1. Collateral-Free and Guarantor-Free Loans:

- Students can avail loans up to ₹10 lakh for studies in India to cover tuition fees, hostel fees, mess charges, and other course-related expenses (e.g., books, laptops).

- No need for collateral or a third-party guarantor, reducing barriers for economically weaker students.

2. Credit Guarantee:

- For loans up to ₹7.5 lakh, the government provides a 75% credit guarantee on outstanding defaults, encouraging banks to offer loans to more students.

3. Interest Subsidy:

- Students with a family income of up to ₹8 lakh annually receive a 3% interest subvention on loans up to ₹10 lakh during the moratorium period.

- An additional full interest subvention is available under the PM-USP Central Sector Interest Subsidy (CSIS) for students with a family income of up to ₹4.5 lakh pursuing technical or professional courses in approved institutions.

4. Wide Coverage:

- The scheme covers 22 lakh students annually across 860 QHEIs, with the list updated yearly based on the latest NIRF rankings.

- Applicable to all Regional Rural Banks (RRBs), scheduled banks, and cooperative banks.

5. Digital Application Process:

- The PM Vidyalaxmi portal offers a seamless, transparent platform for applying for loans and tracking application status in real-time. Interest subsidies are disbursed via E-vouchers and Central Bank Digital Currency (CBDC) wallets.

PM Vidyalaxmi Scheme – Documents Required

To apply for the PM Vidyalaxmi Scheme and interest subsidies, prepare digital copies (PDF/JPEG, under 2 MB) of the following documents:

- Identity Proof: Aadhaar card (mandatory), PAN card, passport, or voter ID.

- Proof of Admission: Admission letter, course details, and fee structure from the QHEI.

- Academic Records: Class 10/12 mark sheets, entrance exam scorecard (e.g., JEE, NEET, CLAT).

- Income Proof (for Interest Subsidy): Income certificate issued by a competent authority (e.g., Tehsildar), ITR, Form 16, or affidavit for self-employed parents (issued within the last six months).

- Bank Details: Account number, IFSC code, cancelled cheque, or passbook copy.

- Other Documents: Passport-sized photographs, proof of residence (e.g., Aadhaar, utility bill), fee receipt, or bank-specific documents.

- For Interest Subvention (Additional): Declaration confirming no other Central/State scholarship or subsidy is being availed.

Tip: Ensure documents are clear, legible, and meet portal size requirements. Keep originals for potential bank verification.

How to Apply for PM Vidyalaxmi Scheme?

Applying for the PM Vidyalaxmi Scheme 2025 is a straightforward, fully digital process designed to make education loans accessible to Indian students. The scheme, administered by the Department of Higher Education, Ministry of Education, uses the PM Vidyalaxmi portal to streamline applications for collateral-free and guarantor-free loans. Below is a detailed, step-by-step guide to help students apply for the scheme with ease, ensuring clarity and completeness for a hassle-free experience.

Step 1: Verify Eligibility

Before starting the application process, ensure you meet the eligibility criteria:

- You must be an Indian citizen.

- You should have secured admission to one of the 860 Quality Higher Education Institutions (QHEIs) listed under the scheme, based on NIRF rankings (top 100 institutions, state HEIs ranked 101-200, or central government-governed institutions).

- Admission must be through a merit-based process or open competitive examination.

- For interest subsidies, your family’s annual income should be up to ₹8 lakh (or ₹4.5 lakh for full interest subvention under PM-USP CSIS for technical/professional courses).

- Check the list of eligible QHEIs on https://dashboard.aishe.gov.in or the PM Vidyalaxmi portal.

Tip: Confirm your institution’s eligibility early to avoid wasting time on an ineligible application.

Step 2: Gather Required Documents

Prepare all necessary documents in digital format (PDF or JPEG, as specified on the portal) to ensure a smooth application process. Commonly required documents include:

1. Identity Proof:

- Aadhaar card (mandatory for most banks).

- PAN card (if available).

- Passport or voter ID (if specified by the bank).

2. Proof of Admission:

- Admission letter or offer letter from the QHEI.

- Course details, including duration and fee structure (available from the institution).

3. Academic Records:

- Class 10 and 12 mark sheets and certificates.

- Entrance exam scorecard (e.g., JEE, NEET, CLAT) or merit list proof, if applicable.

4. Income Proof (for Interest Subsidy):

- Income certificate issued by a competent authority (e.g., Tehsildar or equivalent).

- ITR (Income Tax Return) or Form 16 of parents/guardians (for salaried individuals).

- For self-employed parents, an affidavit or income proof certified by a gazetted officer.

5. Bank Details:

- Bank account number and IFSC code (for loan disbursement).

- Cancelled cheque or bank passbook copy.

6. Other Documents:

- Passport-sized photographs (digital format).

- Proof of residence (e.g., Aadhaar, utility bill).

- Fee receipt or demand letter from the institution for tuition and other expenses.

- Any additional documents specific to the chosen bank’s loan scheme (check on the portal).

Tip: Scan documents clearly and ensure file sizes meet portal requirements (usually under 2 MB per file). Keep originals handy for verification if requested by the bank.

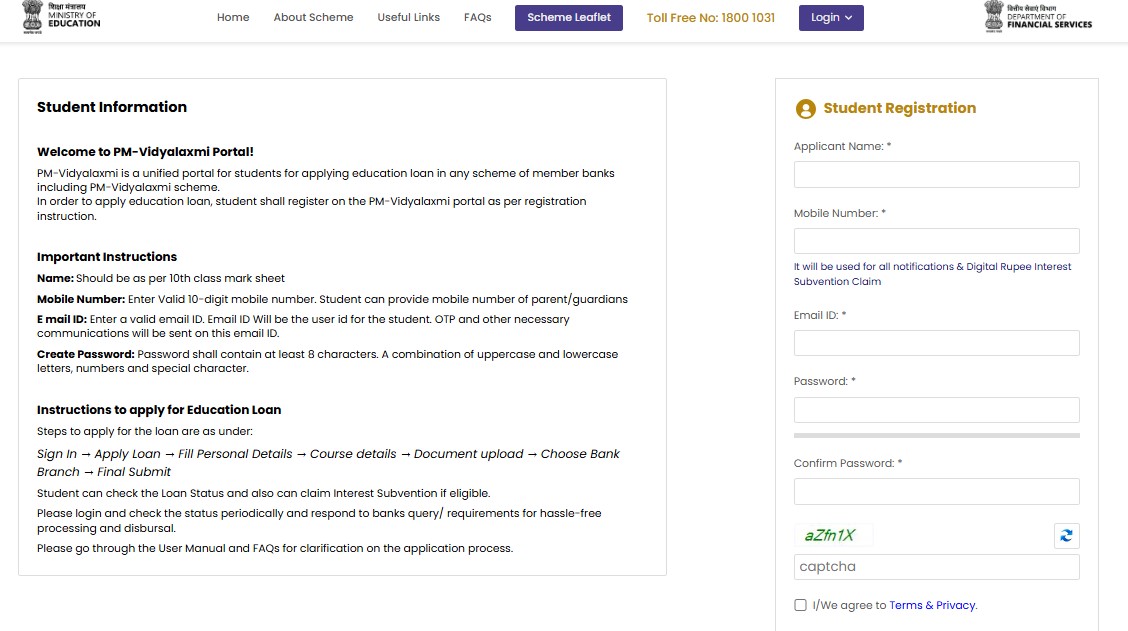

Step 3: Register on the PM Vidyalaxmi Portal

The application process is entirely online via the PM Vidyalaxmi portal. Follow these steps to register:

1. Visit the official portal: https://pmvidyalaxmi.co.in.

2. Click on the “Register” or “Sign Up” button.

3. Provide basic details:

- Full name (as per Aadhaar).

- Mobile number (linked to Aadhaar for OTP verification).

- Email address (for communication and updates).

- Create a secure password.

4. Verify your mobile number and email via OTPs sent by the portal.

5. Log in using your credentials after successful registration.

Tip: Use a reliable email and mobile number, as all communications, including loan approval and status updates, will be sent to these.

Step 4: Fill the Common Education Loan Application Form (CELAF)

Once registered, complete the Common Education Loan Application Form (CELAF) on the portal. This standardized form simplifies the process by allowing you to apply to multiple banks with a single application. Here’s how to fill it:

1. Log In: Access your account on the PM Vidyalaxmi portal.

2. Locate the Application Form: Navigate to the “Apply for Loan” section.

3. Enter Personal Details:

- Name, date of birth, gender, and Aadhaar number.

- Permanent and current address.

- Parent/guardian details (name, occupation, contact information).

4. Provide Academic and Course Details:

- Name of the QHEI and course (e.g., B.Tech, MBBS).

- Course duration and start date.

- Total tuition fees and other expenses (hostel, mess, books, etc.).

- Upload proof of admission and fee structure.

5. Specify Loan Requirements:

- Enter the loan amount needed (up to ₹10 lakh for studies in India).

- Mention expenses to be covered (e.g., tuition, hostel, equipment).

6. Income Details (for Interest Subsidy):

- Provide family income details and upload the income certificate.

- Indicate if you’re applying for the 3% interest subvention or PM-USP CSIS (for income up to ₹4.5 lakh).

7. Bank Preferences:

- Select up to three loan schemes from the 84 education loan schemes offered by 38 registered banks (as of April 2025).

- Compare interest rates, repayment terms, and other conditions displayed on the portal.

Tip: Double-check all entries for accuracy. Errors in Aadhaar number, course details, or income information can lead to application rejection.

Step 5: Upload Documents

After filling the CELAF, upload the required documents in the specified format:

- Go to the “Upload Documents” section on the portal.

- Upload each document in the designated fields (e.g., identity proof, admission letter).

- Ensure files are clear, legible, and within the size limit (check portal guidelines).

- Submit the form after uploading all documents.

Tip: Save a backup of all uploaded files on your device or cloud storage for future reference.

Step 6: Select and Apply to Banks

The PM Vidyalaxmi portal allows you to choose up to three loan schemes from participating banks, including public sector banks, regional rural banks, and cooperative banks. Here’s how:

1. Use the portal’s “Loan Schemes” section to browse available options.

2. Filter schemes based on:

- Interest rates.

- Repayment tenure (typically up to 15 years after the moratorium period).

- Eligibility criteria specific to each bank.

3. Select up to three schemes and submit your application to the chosen banks through the portal.

4. The portal forwards your CELAF and documents to the selected banks for processing.

Tip: Prioritize banks with lower interest rates and flexible repayment terms. Check if the bank has a branch near your institution for easier coordination.

Step 7: Track Application Status

The PM Vidyalaxmi portal provides real-time tracking of your application status:

- Log in to your portal account.

- Go to the “Track Application” section.

- View the status of your application for each bank (e.g., “Under Review,” “Approved,” “Rejected”).

- Receive notifications via email or SMS for updates, such as requests for additional documents or loan approval.

Tip: Regularly check the portal for updates, especially during peak application periods, as banks may take a few weeks to process applications.

Step 8: Loan Sanction and Disbursement

Once a bank approves your application:

- The bank will issue a sanction letter detailing the loan amount, interest rate, repayment terms, and moratorium period (course duration + 1 year).

- Review and accept the terms via the portal or by visiting the bank branch (if required).

- The loan amount will be disbursed directly to the institution’s account for tuition fees or to your bank account for other expenses (e.g., hostel, books).

- For interest subsidies, the portal will issue E-vouchers or transfer funds via Central Bank Digital Currency (CBDC) wallets to cover the subsidized portion during the moratorium period.

Tip: Keep the sanction letter and disbursement details safe, as they are required for loan repayment and subsidy claims.

Step 9: Address Grievances (If Any)

If you face issues during the application process, such as delays, rejections, or technical glitches:

1. Contact the PM Vidyalaxmi helpline or support email provided on the portal.

2. Reach out to Canara Bank, the nodal agency for the scheme, at:

- Toll-free number: 1800 1031

- Email: hoel@canarabank.com or hogps@canarabank.com

3. Use the portal’s grievance redressal section to log complaints and track their resolution.

Tip: Document all communication with the bank or portal support for quick resolution of issues.

Tips for a Smooth Application Process of PM Vidyalakshmi Scheme

- Apply Early: Submit your application as soon as you receive your admission letter to avoid delays, especially during peak admission seasons.

- Compare Loan Schemes: Use the portal’s comparison tool to select schemes with favorable terms. Check for hidden charges or processing fees.

- Ensure Accurate Income Proof: For interest subsidies, submit a valid income certificate issued within the last six months.

- Check Portal Updates: The list of QHEIs and loan schemes is updated annually, so verify the latest information on the portal.

- Avoid Multiple Applications: Submitting multiple CELAFs for the same course can lead to rejection. Stick to one application with up to three bank preferences.

- Secure Your Account: Use a strong password and avoid sharing login credentials to protect your application data.

How to Apply for Interest Subvention?

To avail the 3% interest subvention (family income up to ₹8 lakh) or full interest subvention under PM-USP CSIS (family income up to ₹4.5 lakh for technical/professional courses):

- Indicate Subsidy During Application: While filling out the CELAF, select the option for interest subvention and specify your family income.

- Upload Income Proof: Submit a valid income certificate, ITR, Form 16, or affidavit (issued within the last six months).

- Declare No Other Subsidies: Confirm you are not availing other Central/State scholarships or subsidies.

- Submit and Verify: After loan approval, the portal verifies income details for subsidy eligibility.

- Receive Subsidy: Subsidies are disbursed via E-vouchers or Central Bank Digital Currency (CBDC) wallets during the moratorium period (course duration + 1 year).

Tip: Ensure income documents are accurate to avoid subsidy rejection.

How to Track Loan Application Status?

To monitor your application in real-time:

- Log in to https://pmvidyalaxmi.co.in with your credentials.

- Navigate to the “Track Application” section.

- View the status for each bank (e.g., “Under Review,” “Approved,” “Rejected,” “Additional Documents Required”).

- Check email or SMS for notifications on updates or requests for additional documents.

- Contact the bank directly (via details provided in notifications) if clarification is needed.

Tip: Check the portal weekly, especially during peak seasons, as processing may take a few weeks.

How to Raise a Grievance at PM Vidyalakshmi Scheme?

If you face issues (e.g., application delays, rejections, portal errors):

1. Log in to https://pmvidyalaxmi.co.in.

2. Go to the “Grievance” or “Help” section.

3. Fill the grievance form with:

- Applicant details (name, application ID, contact info).

- Issue description (e.g., delay, document rejection).

- Supporting documents (e.g., screenshots, email correspondence).

4. Submit the grievance and note the grievance ID for tracking.

5. Alternatively, contact Canara Bank (nodal agency) at:

- Toll-free: 1800 1031

- Email: hoel@canarabank.com or hogps@canarabank.com

Tip: Provide clear details and evidence to expedite resolution.

How to Track Grievance Redressal at PM Vidyalakshmi Scheme?

To monitor the status of your grievance:

- Log in to https://pmvidyalaxmi.co.in.

- Navigate to the “Grievance Status” or “Track Grievance” section.

- Enter your grievance ID to view updates (e.g., “Under Review,” “Resolved”).

- Check email/SMS for notifications on resolution or additional requirements.

- If unresolved, escalate to Canara Bank via 1800 1031 or email, quoting the grievance ID.

Tip: Document all communications and keep the grievance ID handy.

Key Features of PM Vidyalakshmi Scheme

- No Income Limit for Loans: Any QHEI student can apply; subsidies are income-based.

- Loan Coverage: Up to ₹10 lakh for tuition, living, and course-related costs.

- Annual Updates: QHEI list refreshed yearly via NIRF rankings.

- Integration: Complements PM-USP CSIS and Credit Guarantee Fund Scheme for Education Loans (CGFSEL).

Key Points to Remember

- The PM Vidyalaxmi Scheme covers loans up to ₹10 lakh for tuition, hostel, and other course-related expenses in India.

- No collateral or guarantor is required, making it accessible for students from all economic backgrounds.

- The 3% interest subvention is available for families with an income of up to ₹8 lakh, and full interest subvention under PM-USP CSIS for incomes up to ₹4.5 lakh.

- The application process is entirely digital, reducing paperwork and ensuring transparency.

- As of April 2025, 38 banks offer 84 loan schemes under the program, but some banks have reported delays in processing due to implementation challenges. Check the portal for real-time updates.

PM Vidyalakshmi Scheme – Challenges and Current Status

As of April 1, 2025, public sector banks have reported slow uptake of the scheme, with 76% of 2,963 applications still pending due to implementation concerns raised by banks. The government is addressing these issues to ensure smoother execution.

Why Does the PM Vidyalaxmi Scheme Matter?

The PM Vidyalaxmi Scheme is a game-changer for Indian students, particularly those from economically weaker and marginalized communities. By offering collateral-free loans, interest subsidies, and a digital application process, it ensures that financial barriers do not prevent talented youth from accessing quality education. The scheme supports India’s vision of inclusive education, aligning with NEP 2020 and fostering better career opportunities and economic prospects for millions of students.

Tips for Students Applying for PM Vidyalakshmi Scheme

- Verify QHEI Eligibility: Check if your institution is among the top 860 QHEIs listed on https://dashboard.aishe.gov.in.

- Prepare Documents in Advance: Keep digital copies of identity proof, admission letter, and income certificate ready for quick uploads.

- Compare Loan Schemes: Use the PM Vidyalaxmi portal to compare interest rates and terms offered by different banks.

- Apply Early: Submit your application as soon as you secure admission to avoid delays in loan processing.

Contact Support for Grievances: For issues related to the scheme, reach out to Canara Bank at 1800 1031 or email hoel@canarabank.com or hogps@canarabank.com.

PM Vidyalaxmi Scheme 2025 – FAQs

What is the maximum loan amount under the PM Vidyalaxmi Scheme?

Up to ₹10 lakh for tuition, hostel, books, laptops, and other course-related expenses.

Do I need collateral or a guarantor for the loan?

No, the PM Vidyalaxmi Scheme offers collateral-free and guarantor-free loans.

Who is eligible for the 3% interest subsidy?

Students with family income up to ₹8 lakh annually are eligible for a 3% subsidy on loans up to ₹10 lakh during the moratorium period.

Can I apply if my family income is above ₹8 lakh?

Yes, you can still apply, but you won’t be eligible for the 3% interest subsidy.

What is the full interest subvention under PM-USP CSIS?

Students with family income up to ₹4.5 lakh pursuing technical or professional courses get 100% interest subsidy during the moratorium.

Which institutions are eligible under the scheme?

All QHEIs including NIRF top 100, state HEIs ranked 101–200, and central government-run institutions.

How do I check if my institution is a QHEI?

Visit https://dashboard.aishe.gov.in or the PM Vidyalaxmi portal to view the latest list of QHEIs.

Can I apply for multiple loans under the scheme?

No, only one CELAF form with up to three bank preferences is allowed to prevent duplication or rejection.

What expenses are covered by the loan?

The loan covers tuition fees, hostel/mess charges, books, laptops, and other necessary academic expenses.

How long is the loan repayment period?

Repayment can extend up to 15 years after the moratorium (course period + 1 year), depending on the lending bank.

What documents are needed for the application?

Aadhaar card, admission letter, previous academic records, income certificate (for subsidy), bank details, and passport-size photographs.

How do I track my application status?

Log in to the PM Vidyalaxmi portal and use the 'Track Application' option. Updates are also sent via SMS/email.

Can I apply for the scheme after starting my course?

Yes, if you're enrolled in a QHEI and meet the eligibility requirements, you can apply after the course begins.

How are interest subsidies disbursed?

Subsidies are credited via E-vouchers or Central Bank Digital Currency (CBDC) wallets through the PM Vidyalaxmi portal.

we have karnataka bank ltd account holder we also receive pm vidyalaxmi loan pl reply