However, the relevance of filing an Income Tax Return (ITR) extends far beyond merely fulfilling tax obligations. In today’s financial ecosystem, the ITR serves as an official proof of income and is a crucial document for availing a wide range of services across both public and private sectors. These include applying for bank loans, obtaining credit cards, securing visas, and even renting property. Moreover, it demonstrates financial transparency and credibility and offers a clear record of an individual’s income patterns and financial discipline over the years.

For students and their families, especially those seeking scholarships or education loans, the Income Tax Return (ITR) has become an essential financial document. It is often used to demonstrate financial need, establish eligibility for subsidies, and support visa applications for studying abroad. Even if the income falls below the taxable limit, voluntarily filing an ITR can offer significant long-term benefits.

In the below article, we will explore how ITR impacts a student’s academic journey, particularly in the context of securing scholarships and financial aid, while also understanding the process, documentation required to file it and other related information.

Benefits of Filing an ITR

Filing an ITR offers multiple tangible and intangible benefits, making it a financial best practice for all eligible citizens and especially critical for families supporting students. While many believe ITR is only mandatory for individuals earning above ₹4 lakh annually, it is strongly recommended for everyone, including those with incomes below the taxable limit.

1.) One of the primary benefits of filing ITR is that it serves as legitimate income proof. This becomes particularly important for families applying for scholarships or education loans on behalf of their children. Many financial institutions, NGOs, and government bodies require documented proof of income to assess whether an applicant qualifies under a need-based category of the scholarship. ITR is widely accepted and trusted for this purpose, as it is verified and stored in the government’s official tax database.

2.) Another critical benefit is access to education loans. Most banks ask for the ITRs of the co-applicant, usually a parent(s) or guardian(s) for the previous 2–3 financial years. A consistent ITR filing history can speed up the loan approval process and improve credibility.

3.) Individuals can claim various deductions and exemptions under sections like 80C (tuition fees) and 80E (interest on education loans). This helps reduce the tax burden and allows for more funds to be allocated towards the student’s education.

4.) Regular ITR filing builds a positive financial profile, which is beneficial for visa applications, government grants, and scholarship renewals. At its core, filing an Income Tax Return (ITR) is more than a regulatory requirement – it is a powerful enabler of financial independence and access to academic opportunities.

Relevance and Significance of ITR in Today’s Context

In today’s digital-first, policy-driven environment, the significance of ITR goes far beyond its traditional role in income tax compliance. The ITR has evolved into a multi-functional financial document that validates income, supports transparency, and facilitates access to essential services. For both individuals and families, especially those with students in school or college, its relevance has become even more pronounced.

The Income Tax Department of India reported that over 7.8 crore ITRs were filed during the financial year 2023–24, a clear indicator that more citizens are realizing the utility of this document. In urban and semi-urban India, where families often seek scholarships, loans, and government benefits, having an ITR is seen as essential, even when income levels are modest.

One key area where ITR holds particular importance is in applying for student financial aid or scholarships. Whether one applies for government schemes via the National Scholarship Portal (NSP) or through CSR-funded scholarships by private entities, ITR is frequently requested to verify the economic background of the applicant’s family. Without this, applications may be rejected or downgraded in the selection process.

Additionally, many government subsidies such as LPG benefits, maternity schemes, and Kisan schemes require ITR as a prerequisite. Even visa applications, particularly student and dependent visas, often mandate submission of 2–3 years of ITRs from the financial sponsor to assess financial stability.

Therefore, in today’s data-backed policy ecosystem, ITR plays a crucial role in enabling access, proving credibility, and securing support, especially for students aiming for higher education and beyond.

Types of Income Tax Return (ITR)

The Income Tax Department of India has prescribed different ITR (Income Tax Return) forms for different categories of taxpayers, based on the nature and amount of their income. Here is the tabular representation of the data:

| ITR Form | Applicable For | Income Sources | Conditions |

| ITR-1 (Sahaj) | Resident Individuals (Not HUF*) | – Salary/Pension

– One House Property – Other Sources (Interest, etc.) |

– Income ≤ ₹50 lakh

– No capital gains – No foreign income – Not for Directors or unlisted co-shareholders |

| ITR-2 | Individuals & HUFs (Not having income from business/profession) | – Salary

– House Property – Capital Gains – Foreign Income – Other Sources |

– For income > ₹50 lakh

– Includes capital gains, foreign income – Not for business/profession income |

| ITR-3 | Individuals & HUFs having income from business/profession | – Business or Professional Income

– Salary, House Property, Capital Gains, etc. |

– For proprietors, freelancers, professionals

– Includes income from partnership firm |

| ITR-4 (Sugam) | Resident Individuals/HUFs/Firms (other than LLPs) | – Presumptive Income from Business (Sec 44AD)- Presumptive Income from Profession (Sec 44ADA)

– Transport Business (Sec 44AE) |

– Business income ≤ ₹2 crore- Profession income ≤ ₹50 lakh

– Not for foreign income, directors, or unlisted co-shareholders |

| ITR-5 | Firms, LLPs, AOPs, BOIs, Artificial Juridical Persons | All types of income except those covered under ITR-7 | Not for individual, HUF, or company filers |

| ITR-6 | Companies (except those claiming exemption under Sec 11) | All income including business, capital gains, etc. | Not for charitable or religious organizations |

| ITR-7 | Persons required to file under Sec 139(4A), 139(4B), 139(4C), 139(4D) | – Charitable/religious trust- Political parties- Institutions, universities, research bodies | Must be eligible under the specified sections |

*A Hindu Undivided Family (HUF) refers to a family that includes all persons descended from a common ancestor, including their spouses and children. It is treated as a separate unit for income tax purposes in India.

Importance of ITR in Student Life

At first glance, one might assume that a student – particularly one without an income has little to do with ITR filing. However, in the broader educational and financial context, ITR holds critical importance in a student’s journey, whether it’s for scholarships, loans, or overseas education. It often becomes a determining factor in a student’s access to opportunities.

- Firstly, for need-based scholarships, institutions and government bodies generally require proof of parental or guardian income. While salary slips or employer certificates may suffice, they are not always available or verifiable. This is where ITR steps in. As a government-authenticated income record, it becomes the gold standard for verifying financial eligibility.

- Secondly, students applying for education loans – particularly in India, will find that banks insist on ITRs of the co-borrower for the previous 2–3 financial years. It helps the bank evaluate repayment capacity and financial credibility. In many cases, even a minor inconsistency in ITR records can delay or derail loan approvals, affecting the student’s academic timeline.

- Moreover, students planning to study abroad often find ITR useful during visa processing. Embassies of countries like the USA, UK, Canada, and Australia often request financial documents from the sponsor. In these scenarios, 2–3 years of ITR filings become necessary in proving that the student has adequate financial support.

- ITR also plays significant roles during scholarship renewals. Many programs re-evaluate the student’s financial status every academic year, and ITR is among the most trusted documents for this review. Therefore, even though students may not be the direct filers, the presence of ITRs within their household can significantly affect their academic mobility and financial aid prospects.

Usage of ITR in Securing Scholarships

Income Tax Returns (ITRs) are among the most commonly requested documents during the scholarship application process, especially when the scholarships are need-based. Whether the program is run by the central or state government, a private corporation, or a nonprofit organization, ITR often serves as a key document for assessing the family’s income and financial status.

Let’s understand with the help of an example of the National Scholarship Portal (NSP) – India’s largest platform for disbursing government scholarships. Most scholarships under NSP have income thresholds e.g., ₹2.5 lakh, ₹4 lakh, or ₹6 lakh annually. Applicants must submit income certificates to validate their income. ITR filings serve as the most reliable and verifiable form of such certification, as they are backed by government records.

Similarly, CSR and NGO-sponsored scholarships hosted on platforms like Buddy4Study require ITRs during application or shortlisting stages. These organizations use ITR data to ensure that financial assistance goes to truly deserving candidates. For example, Aditya Birla Capital Scholarship, IDFC FIRST Bank MBA Scholarship, Mirae Asset Foundation Scholarship Program and more require ITRs for at least two financial years.

Furthermore, merit-cum-means scholarships also use ITRs to validate the “means” component. Even if a student scores high academically, their ITR-backed family income level helps determine the grant amount or selection priority.

Notably, some state government scholarships now automatically verify income via the Income Tax Department’s database when an ITR is submitted, improving transparency and reducing fraud.

Hence, a well-documented and timely-filed ITR becomes a powerful enabler for students and increases their chances of being selected for scholarships and sustaining their academic pursuits with financial backing.

Documents Required for Filing an ITR

Individuals who are planning to file an Income Tax Return (ITR) are required to keep the below listed documents handy while applying for it:

Basic Documents (for all taxpayers):

- PAN Card

- Aadhaar Card

- Form 16 – Issued by employer (for salaried individuals)

- Bank Account Details – Account number, IFSC, etc.

- Form 26AS – Tax Credit Statement (download from TRACES portal)

- Annual Information Statement (AIS) – Details of financial transactions (available on the income tax portal)

Income-Related Documents:

For Salaried Individuals:

- Form 16 from employer(s)

- Salary slips (optional, but useful for cross-verification)

For Self-employed / Business Professionals:

- Balance sheet, profit & loss account

- Details of business income and expenses

For Other Income Sources:

- Interest Income: Bank statements / Form 16A from banks

- Rental Income: Rent agreement, municipal tax receipts

- Capital Gains: Sale deed, broker contract notes, purchase and sale value details (for stocks, property, mutual funds)

- Dividend Income: AIS/Form 26AS (for auto-reflected amounts)

Tax-Saving & Deduction Proofs (for claiming deductions):

- Section 80C: LIC premium receipts, PPF passbook, ELSS statements, tuition fee receipts, etc.

- Section 80D: Health insurance premium payment receipts

- Section 80E: Education loan interest certificate from financial institutions

- Section 24(b): Home loan interest certificate from lender

- Section 10(14) (HRA Exemption): Rent receipts, landlord’s PAN (if annual rent exceeds ₹1 lakh)

Assets & Liabilities (if applicable):

- Required if taxable income exceeds ₹50 lakh: Details of movable & immovable assets

Other Useful Documents:

- Aadhaar-linked mobile number (for e-verification of ITR)

- Original ITR acknowledgment (if revising a previously filed return)

- Proof of foreign income/assets (for Indian residents with global income)

How to File an ITR: Step-by-Step Process

Understanding the process of filing an Income Tax Return (ITR) is important for students and their families, especially when using ITR as a tool for financial planning or scholarship applications. The Government of India has made the process largely digital and allows users to file their returns easily through the Income Tax e-Filing portal. The individuals can file an ITR by following 2 methods:

Online Method:

Step 1: Visit the official Income Tax e-Filing website at incometax.gov.in/iec/foportal, navigate to the ‘Register’ button and click on it.

Step 2: Enter your PAN number and click on the ‘Validate’ button. Those who are already registered can simply login.

Step 3: Once you validate your PAN, click on continue fill details, verify them and secure your account to complete the registration process.

Step 4: After successful registration, enter your PAN/Aadhaar/Other user ID and password to login.

Step 5: Select your assessment year from the dropdown menu, mode of filing (online/offline), ITR type and click on ‘Continue.’

Step 6: Now, upload your jason file and click on proceed verification to complete the ITR filing process.

Offline Method:

Visit the official website of Income Tax e-Filing portal at incometax.gov.in/iec/foportal

Method 1 – Steps to Generate and Upload the JSON File Using Excel Utility

Step 1: Visit the official income tax e-filing website and download the utility files (ITR 1 to ITR 7) by selecting the appropriate assessment year in the ‘Download’ section. Extract the ZIP file after downloading.

Step 2: To unlock the utility file, right-click on the Excel utility file, select Properties, click Unlock, and then click Apply.

Step 3: Now, open the Excel utility and either enter the data manually, import a JSON file, or use pre-filled data to complete the ITR form. After this, validate all the sheets/tabs and calculate the tax.

How to Generate and Upload JSON File:

- Once validated, generate the JSON file.

- Log in to the Income Tax e-Filing Portal.

- Go to: e-File > Income Tax Returns > File Income Tax Return.

- Select the Assessment Year and choose Offline Mode.

- Select the ITR Form, then click Continue.

- Upload the generated JSON file and click Proceed to Verification.

Step 4: After successfully uploading the JSON. You can e-Verify your returns online using:

- OTP on mobile number registered with Aadhaar, or

- EVC generated through your pre-validated bank account, or

- EVC generated through your pre-validated demat account, or

- EVC through ATM (offline method), or

- Net Banking, or

- Digital Signature Certificate (DSC).

Method 2 – Steps to File Income Tax Return (ITR) Using the Offline JSON Upload

Step 1: Visit the official e-filing portal. Download the applicable ITR utility based on your requirements. A Common Offline Utility is available for ITR-1 to ITR-4 as a combined file, while separate offline utilities are provided for ITR-5, ITR-6, and ITR-7. If preferred, Excel utilities are also available for ITR-1 to ITR-7. macOS users can download a separate version of the utility available in the same section.

Step 2: Extract the downloaded ZIP file and open the utility from the extracted folder to begin.

Step 3: Run the JSON utility, fill in the ITR form, and click on the ‘Continue’ button to proceed.

- To begin filing your return, navigate to Returns > File Return, then download the Pre-filled Data from the portal; next, import the data by entering your PAN, selecting the relevant assessment year, attaching the pre-filled JSON file, and clicking ‘Proceed‘.

- Click on File Return > Continue, choose the correct ITR form, and proceed.

- You can also import a draft ITR filled online or upload a JSON file created using the Excel or HTML utility.

Step 4: Now, validate all tabs to ensure data accuracy, confirm tax calculations, preview the return for any errors, and proceed with final validation to ensure the utility reports zero errors before generating the JSON file.

Step 5: Log in to the e-Filing portal using your PAN (User ID) and password, upload the validated JSON file, and choose to e-verify the return immediately or at a later time.

Methods for e-verification:To complete the Income Tax Return (ITR) filing process, it is mandatory to verify your return. You can do this through the “E-Verify Now” option, which offers several convenient methods: OTP on the mobile number linked with Aadhaar, Digital Signature Certificate (DSC), Electronic Verification Code (EVC), Net Banking, Bank Account, or Demat Account.

If you already have an EVC or an Aadhaar-linked OTP, you can use those to complete the verification quickly and securely.

e-Verify Later: You can choose to complete the e-verification at a later time. To do so, either log in to the Income Tax e-filing portal and navigate to e-File > Income Tax Returns > e-Verify Return, or use the option available on the home page without logging in. In the latter case, you will need to enter your PAN, Assessment Year, Acknowledgment Number, and Registered Mobile Number to proceed with the verification.

Verify via ITR-V: If you are unable to e-verify your ITR using digital methods, please download and print the ITR-V, sign it, and send it via speed post to the Centralized Processing Center, Income Tax Department, Bengaluru – 560500.

Important Verification Notes:

- If using DSC: Attach the signature file generated using the DSC Management Utility.

- If using Aadhaar OTP: Enter the OTP received on the mobile number linked to your Aadhaar.

- If using EVC via bank or demat account: Enter the code received on your registered mobile number.

If you do not verify the return, the filing process remains incomplete. Ensure the return is e-verified or ITR-V is sent within the stipulated time.

Click Here for e-Verification User Manual

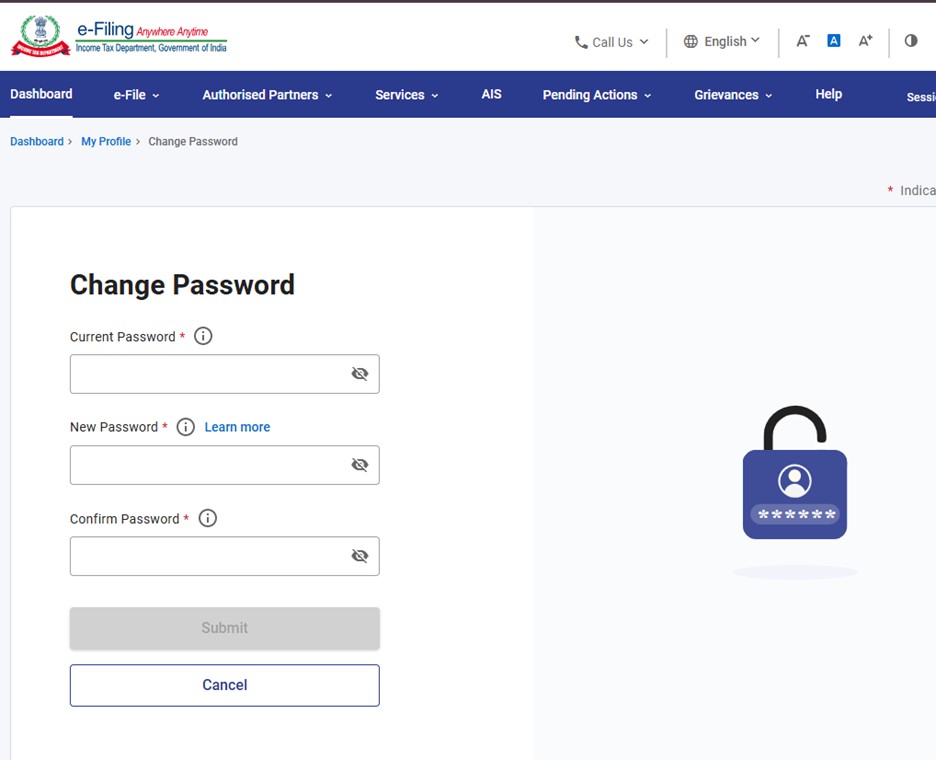

How to Change Password on ITR e-Filing Portal

Before you begin with changing the password on ITR e-Filing portal, make sure you must be a registered user with a valid User ID – either your PAN or Aadhaar and password. Additionally, you have access to your registered email ID and mobile number, as these are essential for verification and communication purposes. Below steps can be followed to change the password:

Step 1: Visit the e-Filing portal, click on Login, and enter your User ID (PAN/Aadhaar) and password to access your dashboard.

Step 2: Click on your profile name in the top-right corner of the dashboard, then select ‘Change Password’ from the dropdown menu.

Step 3: Now enter your current password, choose a new password, and confirm it by entering the new password again.

Step 4: As soon as your password is changed, you will receive a confirmation notification.

Click Here for Changing Password Related FAQs

How to Check Filed ITR Status?

Individuals can easily check the status of their ITR filed on the official website by following the below-mentioned steps:

Step 1: Visit the official website and login to your ITR account.

Step 2: Once you login, navigate to the e-File option at the left hand side of the dashboard, select Income Tax Returns in the drop-down menu, and then to ‘View Filed Returns.’

Step 3: In this section, you will be able to see your ITR status and also download the intimation order. An Intimation Order under Section 143(1) is a notice from the Income Tax Department after processing your ITR, showing acceptance or adjustments. It indicates if you have a refund, tax payable, or no discrepancy.

New Income Tax Regime FY 2025-26 (AY 2026-27)

Under the new tax regime for FY 2025–26, individuals earning up to ₹12 lakhs can potentially have zero tax liability, thanks to the revised slab rates and applicable rebates. The modified slab rates for new tax regime applicable for FY 2025-2026 are as follows:

| Income Tax Slabs | Tax Rates |

| Up to ₹4,00,000 | NIL |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

- The rebate under Section 87A has been increased from ₹25,000 to ₹60,000 under the new tax regime. As a result, individuals with income up to ₹12,00,000 will have zero tax liability under this regime.

- It is important to note that the rebate is not applicable to income taxed at special rates, such as capital gains under Section 112A.

- Marginal relief on the rebate continues to be available.

Understanding Old and New Tax Regime

With the introduction of the new tax regime, taxpayers now have the option to choose between two distinct systems for computing their income tax. Each regime offers its own set of benefits, depending on an individual’s income structure, deductions, and financial planning. While the old regime allows for various exemptions and deductions, the new regime offers lower tax rates with limited exemptions, making tax filing simpler. The comparison below highlights key differences to help taxpayers make an informed decision.

| Criteria | Old Tax Regime | New Tax Regime (Default from FY 2025-26) |

| Basic Exemption Limit | ₹2.5 lakh | ₹4,00,000 |

| Standard Deduction | ₹50,000 | ₹75,000 |

| Deductions under Section 80C | Allowed (up to ₹1.5 lakh) | Not Allowed |

| Deductions under Section 80D | Allowed (Health Insurance Premium) | Not Allowed |

| HRA Exemption | Allowed | Not Allowed |

| LTA Exemption | Allowed | Not Allowed |

| Other exemptions (e.g., 80G, etc.) | Allowed | Not Allowed |

| NPS Employer Contribution (80CCD(2)) | Allowed | Allowed |

| Ease of Compliance | Complex (due to multiple deductions) | Simpler with minimal paperwork |

| Best For | Those with investments & exemptions | Those with little to no deductions |

| Default Regime from FY 2025-26 | No (must be opted manually) | Yes (default) |

| Option to Switch | Salaried can choose each year | |

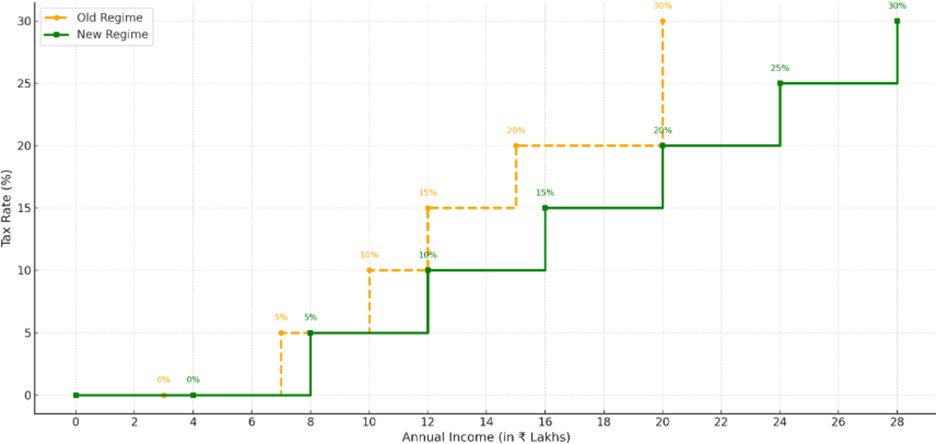

Tax Slabs Comparison for Financial Year 2025-26 (Old vs New Regime):

This graph compares the income tax rates under the old and new tax regimes in India based on annual income. The old regime (dashed orange line) shows fewer but larger tax slabs, with a sharp jump to 30% at ₹15 lakhs. The new regime (solid green line) offers more gradual increments, with tax rates increasing in smaller steps from 5% to 30%. Overall, the New Regime provides smoother progression but without exemptions available in the old regime.

How to Know your Income Tax Slab?

Individuals without business income must choose between the old and new income tax regimes each financial year. To make an informed decision, it’s important to understand which income tax slab your income falls under, as this directly impacts the amount of tax payable.

To determine your income tax slab, first calculate your taxable income. Under the old tax regime, individuals can claim exemptions like House Rent Allowance (HRA), Leave Travel Allowance (LTA), and deductions under Sections 80C to 80U. After applying these exemptions and deductions, the resulting amount is your net taxable income.

For instance, if your gross total income is ₹12 lakh and you are eligible for deductions of ₹2.10 lakh (under Sections 80C, 80TTA, 80CCD(1B)), your taxable income becomes ₹9.90 lakh. In the old regime, this falls in the ₹5–10 lakh slab and is taxed at 20%.

Under the new tax regime, a standard deduction of ₹75,000 and deduction under Section 80CCD(2) (up to 14% of basic salary for employer NPS contributions) are allowed. With a taxable income of ₹11.25 lakh, you now fall in the ₹8-12 lakh slab, taxed at 10%.

ITR Contact Information

For any assistance, individuals can call the toll-free number 1800-103-4215, available from 09:30 hrs to 18:00 hrs between Monday to Friday.

FAQs

When is the last date to file ITR?

For the financial year 2025–26, the Income Tax Department has extended the ITR filing deadline from July 31 to September 15, 2025, due to the late release of ITR forms and filing utilities.

What salary is eligible for ITR?

For salaried individuals in FY 2025–26, the ITR filing threshold is:

- ₹2.5 lakh (below 60 years)

- ₹3 lakh (60–80 years)

- ₹5 lakh (above 80 years)

Under the new tax regime, the limit is ₹4 lakh. Filing is mandatory if you did high-value transactions, paid over ₹25,000 in TDS, or own foreign assets.

What is the tax rebate for 2025-26?

Under the new regime, a rebate of up to ₹60,000 is available for income up to ₹12 lakh (Section 87A), effectively making the tax zero. Under the old regime, the rebate is ₹12,500 for income up to ₹5 lakh.

How is Income Tax Return (ITR) calculated?

ITR is calculated by adding your total income (salary, bonuses, etc.), then subtracting eligible exemptions and deductions. The remaining taxable income is taxed as per the applicable slab rates.

Who is not eligible for ITR?

People with income below the exemption limit and who haven’t made high-value transactions or foreign investments are not required to file ITR. However, voluntary filing is beneficial for loans, visas, and refunds.