Launched in the year 2021, WBSCC provides collateral-free education loans of up to ₹10 lakh at a low interest rate, helping students overcome financial barriers and ensuring they fulfill their dream of getting higher education.

West Bengal Student Credit Card Scheme – Key Highlights

The WBSCC helps eligible students take education loans to cover their study-related expenses without needing to provide any collateral. The loan is available through cooperative banks as well as public and private banks. The interest rate is simple interest at 4% per year. If students pay the interest regularly while they are studying, they get a 1% discount on the interest, which brings it down to just 3% per year.

Key Highlights for West Bengal Student Credit Card Scheme

| Particulars | Details |

| Maximum Loan Amount | ₹10 lakh |

| Interest Rate | 4% simple interest (with possible 1% subsidy) |

| Repayment Period | Up to 15 years, including moratorium (no repayment during course + 1 year grace period) |

| Collateral Required | No |

West Bengal Student Credit Card Scheme – Eligibility Criteria

Applicants must meet the following criteria to be eligible for the Student Credit Card West Bengal-

- The student must be an Indian national and a resident of West Bengal for the past 10 years.

- The applicant must be studying in Class 10 or above.

- The student must be enrolled in higher studies, either within India or abroad, in recognized educational institutions such as schools, madrasahs, colleges, universities, and reputed institutes including IITs, IIMs, IISc, IIEST, ISI, NLUs, AIIMS, NITs, XLRI, BITS, SPA, NID, IIFT, ICFAI Business School, etc.

- The maximum age limit for applicants is 40 years at the time of application.

West Bengal Student Credit Card Scheme – Application Process

Interested and eligible students can apply for the scheme by following the application process given below:

Step 1) Visit the official website – banglaruchchashiksha.wb.gov.in of the Department of Higher Education, Government of West Bengal.

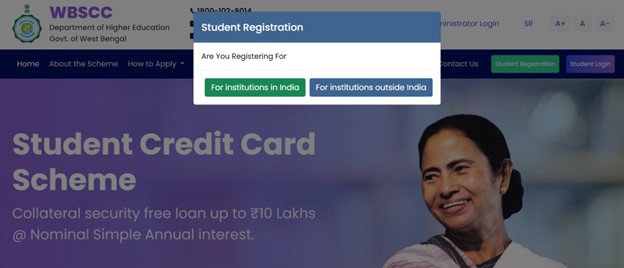

Step 2) Navigate to the ‘Student Registration’ tab and click on it.

Step 3) Choose the preference by clicking on either ‘For Institutions in India’ or ‘For Institutions Outside India’.

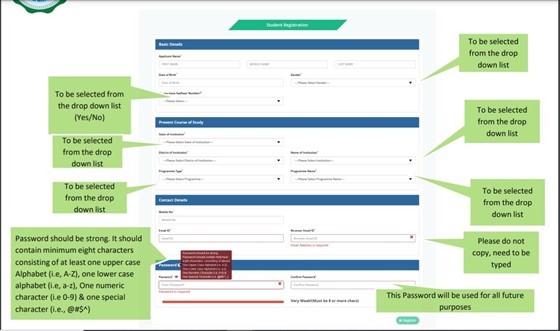

Step 4) Click on the ‘Register’ tab and fill out the required details to create an account.

Step 5) After submitting the details, click on the ‘Student Login’ tab and enter the registered email ID, password and captcha code.

Step 6) Navigate to the ‘Login’ tab and fill out the application form which includes name, email ID, phone number, and other important documents.

Step 7) After submitting, download the application form for future reference.

Also Read – West Bengal Scholarship 2025 – Eligibility, Application Process, Dates, Awards

West Bengal Student Credit Card Scheme – Loan Amount & Interest Rate

The WBSCC stands out for its student-friendly features. The scheme offers collateral-free loans, meaning students are not required to provide valuable assets such as homes, properties, vehicles, or other possessions as security when applying for financial assistance. The scheme offers –

- An education loan at an interest rate of 4% per annum.

- An additional interest rate of 1.5% on the existing interest rate will be charged at prevalent External Benchmark based Lending Rate (EBLR) of the State Bank of India for the entire loan amount of up to ₹10 lakh.

- Girl students will receive an additional concession of 0.5% per year in the interest rate.

- The interest calculated is simple interest instead of compound interest.

- The state government will pay a portion of the interest throughout the loan period so that borrowers are only required to pay a simple interest of 4% per annum.

West Bengal Student Credit Card Scheme – Loan Disbursement Mode

The disbursement of the loan under the scheme follows the following modes:

- Course and Institution-Related Fees: The loan amount towards course fees and other institution-related charges is directly credited to the designated bank account of the respective educational institution. This ensures that fees are paid directly to the institution on behalf of the student.

- Personal Expenses and Purchases: For expenses such as the purchase of a computer or laptop, books, stationery, and living costs, the loan amount is credited to the student’s bank account. This enables students to directly access the funds and manage their personal expenses and necessary purchases effectively.

Also Read – SVMCM 2025: Registration Dates, Eligibility, Rewards and Process

West Bengal Student Credit Card Scheme – Loan Repayment

- The repayment period for any loan availed under the West Bengal Student Credit Card Scheme, including the moratorium period, is set at 15 years, allowing borrowers a substantial timeframe to repay the loan.

- As per the scheme, students may repay their loans through Equated Monthly Installments (EMIs) or other monthly installments.

- If the student pays the interest during the study period, an interest concession of 1% will be provided.

- The student or co-borrower assumes primary responsibility for timely repayment of the loan and holds the first charge in terms of repayment liability.

West Bengal Student Credit Card Scheme – Documents Required

The following documents are required to be uploaded during the online application process:

1. Coloured Photograph (Applicant): The applicant must upload a recent coloured photograph in .jpg/.jpeg format. The file size should be between 20 KB and 50 KB.

2. Coloured Photograph (Co-Applicant): A recent coloured photograph of the co-applicant must be uploaded in .jpg/.jpeg format. The file size should be between 20 KB and 50 KB.

3. Student’s Signature: The student is required to upload their signature in .jpg format. The file size should be between 10 KB and 50 KB, and the background must be white.

4. Co-Applicant/Guardian’s Signature: The co-applicant/guardian must upload their signature in .jpg/.jpeg format. The file size should be between 10 KB and 50 KB, and the background must be white.

5. Student’s Aadhaar Card: The student must upload their Aadhaar card in PDF format. The file size should be between 50 KB and 400 KB. If the applicant does not have an Aadhaar card, they can use Class 10 Board Registration Certificate as a substitute.

6. Age Proof of the Applicant: The applicant must upload a valid age proof document in .pdf format. The file size should be between 50 KB and 400 KB.

7. Address Proof of the Co-Applicant: The co-applicant must upload a valid address proof in .pdf format. The file size should be between 50 KB and 400 KB.

8. Admission Receipt: The admission receipt must be uploaded in .pdf format. The file size should be between 50 KB and 400 KB.

9. Student’s and Guardians’ PAN Card: The student and guardian must upload their PAN Cards in .pdf format. If a PAN Card is not available, an undertaking must be submitted instead. The file size should be between 50 KB and 400 KB.

10. Marksheet of the Last Qualifying Examination: The applicant must upload the marksheet or certificate of their last qualifying examination in .pdf format. The file size should be between 50 KB and 400 KB.

Also Read – Bikash Bhavan Scholarship

West Bengal Student Credit Card Scheme – FAQs

What is the eligibility criteria for the West Bengal Student Credit Card Scheme?

An applicant must be a resident of West Bengal for at least 10 years. The student should be currently enrolled or planning to enroll in Class 10 or higher, which includes undergraduate, postgraduate, professional courses, and PhD programs. The applicant must be below 40 years of age at the time of application. There is no income limit and no minimum marks requirement under this scheme, and it is applicable for studies pursued both in India and abroad.

How can I apply for the West Bengal Student Credit Card online?

Students can apply for the West Bengal Student Credit Card Scheme by visiting the official website at https://wbscc.wb.gov.in. The application process involves registering with an Aadhaar number and mobile number, completing the online application form, and uploading the required documents such as Aadhaar, admission proof, and course fee details.

What is the maximum loan amount and interest rate under the scheme?

Under the West Bengal Student Credit Card Scheme, students can avail an education loan of up to ₹10 lakh. The loan carries a simple interest rate of 4% per annum. Students who regularly pay the interest during the course period are eligible for a 1% interest concession, effectively reducing the interest rate to 3%.

What documents are required to apply for the WBSCC Scheme?

Applicants are required to upload several documents while applying for the scheme, including an Aadhaar card, proof of residence in West Bengal for the last 10 years, mark sheets or certificates of the most recent qualifying examination, an admission letter or proof of enrollment, and the official course fee structure. Passport-size photographs, bank account details, and an income certificate (if applicable) are also required. All documents must be uploaded online in the prescribed format and file size as specified on the official portal.

Can the Student Credit Card be used for paying coaching classes fee?

Yes, the West Bengal Student Credit Card Scheme can be used to fund coaching classes for competitive examinations such as UPSC, WBCS, NEET, JEE, CLAT, and other similar exams. The scheme also supports higher education pursued abroad in recognized institutions. Eligible expenses may include tuition fees, hostel or accommodation charges, books, and living expenses, subject to the guidelines issued under the scheme.