| Official Website | https://www.indianbank.in/ |

| Eligibility | Indian citizens, Non-Resident Indians (NRIs), Persons of Indian Origin (PIOs), Overseas Citizens of India (OCIs) or Individuals born abroad |

| Loan Amount | A maximum of ₹25,00,000 (for Executive Management Program or Executive MBA courses in India) |

| Application Timeline | Always Open |

| Application Mode | Online/Offline |

Indian Bank Education Loan – Eligibility Criteria

The eligibility criteria for the loan scheme are as follows:

- The applicants must be an Indian citizen, Non-Resident Indians (NRIs), Persons of Indian Origin (PIOs), Overseas Citizens of India (OCIs), or individuals born abroad.

- They must have completed their Higher Secondary level (10+2 or equivalent) education.

- The students must have secured admission in undergraduate or postgraduate courses either in India or abroad based on the basis of merit or through an entrance test.

- They can apply for the Indian Bank Education Loan to pursue various programs such as graduation, post-graduation, diploma, or degree courses in either India or abroad.

- Working professionals willing to apply for loans for pursuing Executive Management Programs/Part-Time Executive MBA Programs/Distance Education Mode must have secured admission through an entrance test. They should have the admission offer letter and a minimum of 3 years of work experience.

Indian Bank Education Loan – Eligible Courses

For Pursuing Studies in India

- Programs offered through various Government subsidy initiatives.

- Courses leading to undergraduate or graduate degrees and postgraduate diplomas provided by colleges or universities recognised by the UGC, Government, AICTE, AIB Merchant Services (AIBMS), ICMR, etc.

- Programs such as ICWA, CA, CFA, etc.

- Programs offered by prestigious institutions such as Indian Institute of Management (IIMs), Indian Institute of Technology (IITs), Indian Institute of Science (IISC), Xavier School of Management (XLRI), National Institute of Technology (NITs), National Institute of Design (NIDs), National Institute of Fashion Technology (NIFTs), etc.

- Standard degree or diploma courses in fields like aeronautics, pilot training, shipping, etc., or any other discipline approved by the Director General of Civil Aviation, Shipping, or other relevant regulatory bodies.

- Approved courses provided in India by reputed foreign universities.

- Undergraduate courses offered by Institutes of Hotel Management operating under NCHMCT (National Council for Hotel Management and Catering Technology).

For Pursuing Studies Abroad

- Any of the recognised courses from accredited institutions.

- Undergraduate programs in job-focused professional or technical fields offered by esteemed universities or institutions.

- Postgraduate programs such as MCA, MBA, MS, etc.

- Programs offered by CIMA – London, CPA in the USA, etc.

- Degree or diploma programs in different fields like aeronautics, pilot training, shipping, etc., as long as they are recognised by competent regulatory bodies in India or abroad for employment purposes.

Indian Bank Education Loan – Eligible Institutions

Whether the students are applying for education loans to pursue studies in India or abroad, graduate, postgraduate, MBA, etc., they must apply to the institutions approved by the Indian Bank.

For studies in India, the category of institutions can be found listed in the following documents:

- Annexure – A for premier elite institutions

- Annexure – B for premier special institutions

- Annexure – C for premier institutions.

The recognised courses of colleges/universities/institutions not covered under the above three categories are also approved.

For pursuing studies abroad, institutions ranked 1 to 1000 (premier special institutions) and above 1000 (other institutions) on the official website of Webometrics are approved. Exceptions for this category apply to institutions of Russia, Ukraine, and China.

Indian Bank Education Loan – Benefits

The expenditures considered for offering education loans by the Indian Bank for pursuing studies in India and abroad are as follows:

- Tuition/hostel fees

- Fees meant for examinations, usage of the library and laboratory

- For pursuing studies abroad, expenses incurred on travel, living, and passage based on assessment of living expenses applicable for each country.

- Insurance premium for student borrowers, if requested for finance.

- Caution deposit, building fund, or refundable deposit supported by the institution bills/receipts. These expenses can be considered if they do not exceed 20% of the total tuition fees for the entire course.

- Expenditures incurred for books, equipment, instruments, and uniforms.

- Expenses incurred on the purchase of a computer, if necessary for completing the course.

- Any other expenses required to complete the course, such as academic and maintenance fees, study tours, project work, or thesis.

- At the time of calculation of the loan amount required, any scholarships or fee waivers available to the student borrower will be taken into consideration.

- If the scholarship amount is included in the loan assessment, it should be ensured that the scholarship amount is credited to the loan account upon receipt from the government.

Note:

- Reasonable hostel fees will be considered for lodging and boarding if the student opts for off-campus accommodation.

- For courses under the management quota seats included in the scheme, fees approved by the state government or an approved regulatory body will be sanctioned, subject to the ability to repay.

- The maximum expenditures may be limited to 20% of the total tuition fees paid for completing the course.

- For colleges falling under the Premier Elite/Premier Special Category, a need-based limit may be considered subject to the production of verifiable documentary evidence.

Indian Bank Education Loan – Quantum of Finance

Need-based financial support for pursuing studies in India and abroad will be provided as listed above. A maximum loan amount of ₹25,00,000 is offered for the Executive Management Program/Executive MBA Program.

Indian Bank Education Loan – Loan Margins

The applicants are required to provide a margin percentage as provided below.

| Loan Amount | Margin |

| Up to ₹4,00,000 | Not Required |

| ₹4,00,000 – ₹7,50,000 | 5% (in India), 15% (Abroad) |

| Above ₹7,50,000 | 15% (in India), 20% (Abroad) |

| Up to ₹25,00,000 (only for Executive Management Program/Executive MBA) | 25% (India only) |

Also Read: Top Bank Loans for Education Funding in India: A Comprehensive Analysis!

Indian Bank Education Loan – Required Documentation

For students/applicants:

- Proof of identity and address in accordance with KYC regulations

- Documentation of academic records

- Proof of admission offer or admission letter from the institution

- Summary of study costs or breakdown of expenses

- Passport-sized photos

- Relevant documentation regarding previous or existing loans, if applicable

- Submission of a passport is mandatory for studying abroad

- Aadhaar card

- Permanent Account Number (PAN) is mandatory to be submitted with the application or before the first disbursement

- Email address and social media details for Twitter, Facebook, LinkedIn, etc. (if available) for future communication with the student/co-applicant

For co-applicants/guarantors:

- Proof of identity and address in accordance with KYC regulations

- Passport-size photographs

- Relevant documents of previous or existing loans, if applicable

- Permanent Account Number (PAN) is mandatory to be submitted with the application or before the first disbursement

- Aadhaar card

Any other documents as specified from time to time, will be required.

Indian Bank Education Loan – Security

The security measures involved for all types of education loans are as under:

- The future income of the student borrower will be assigned as primary security.

- Depending on the situation, parent(s)/guardian(s)/spouse will be required to be joint/ co-borrowers.

For future income assignments, the following steps should be followed:

- The applicant’s projected monthly income after completing the course must be provided.

- During the assessment of the proposal, the projected monthly income submitted by the applicant should be verified using the placement record of the college/university/ educational institution, employability prospects based on the chosen course, and other publicly available sources of information regarding the expected annual package.

- Following verification, these details must be documented in the appraisal note without any leniency.

Loans covered under CGFSEL/Government Interest Subsidy up to ₹7,50,000 will have the third-party guarantee/collateral requirement waived.

The collateral security requirements for loans not covered under CGFSEL:

- Premier Elite Category: No collateral security is required for loans up to ₹40,00,000. However, full collateral security covering the entire loan limit is necessary in the form of SARFAESI Compliant Land (bounded and demarcated)/Building/Flat/Govt. Securities/ PSU Bonds/Gold Jewellery/Bank Deposits/NSCs and LIPs (Surrender Value) if the loan limit exceeds ₹40,00,000.

- Premier Special, Premier and Other Institutes (For studies in India and Abroad): Full collateral security covering the entire loan limit is required in the form of SARFAESI Compliant Land (bounded and demarcated)/Building/Flat/Govt. Securities/PSU Bonds/ Gold Jewellery/Bank Deposits/NSCs and LIPs (Surrender Value).

For Executive Management Programme/Executive MBA in ‘Premier Elite Institutions’ only:

- No collateral security is required for Premier Elite Institutes.

- Collateral security is required for the full amount for Premier Special and Premier Institutes.

For staff of the Indian Bank, a Guarantee of PF/NPS nominee is to be obtained additionally. For other borrowers, a third-party guarantee should be obtained with sufficient net worth to cover the loan amount.

If the land/building is already mortgaged with the Indian Bank, the unencumbered portion can be taken as security on an extension of charge basis, provided it covers the required loan amount and accrued interest (if any).

Indian Bank Education Loan – Repayment Period

- The students pursuing studies in India or abroad must repay their education loan in 180 equal monthly instalments (EMIs). The repayment period begins immediately after the moratorium period.

- The students pursuing Executive Management Programme/Executive MBA must repay their education loan in 120 equated monthly instalments (EMIs). The repayment period begins in the month after the first disbursement of the loan, and there are no grace periods. The borrower must make an EMI payment every month, even if it is a holiday.

Indian Bank Education Loan – Interest Rates

- Education Loan: 8.60% to 11.40%

- Education Loan for Premier Elite Category Institutions: 8.20%

Indian Bank Education Loan – Processing Fee

- For pursuing studies in India & abroad

- Up to ₹10 lakh: Not required

- Above ₹10 lakh: 0.15% (Maximum ₹3000)

Important Note:

- The moratorium period is a maximum of one year, and it includes the course period and a holiday period. In simple terms, it refers to a grace period during which borrowers do not have to repay the loan amount.

- Simple interest is charged on the outstanding loan amount from the date of disbursement until the start of repayment, during the study period and the moratorium period.

- The applicants can choose to pay the interest on the loan during the study and the moratorium period before they actually start repaying the loan. If they don’t pay the interest during this time, it will be added to the principal amount, and the EMI for loan repayment will be adjusted accordingly.

Indian Bank Education Loan – Additional Information

Credit Guarantee Fund Scheme for Education Loans (CGFSEL)

- Education loans up to ₹7,50,000 sanctioned through the IBA Scheme are eligible for the Credit Guarantee Fund Scheme for Educational Loans (CGFSEL).

- Third-party guarantee/collateral is waived off.

- Parents and spouses will be the co-obligates or joint borrowers.

- The applicants willing to pursue studies in India and abroad both are eligible.

- The annual guarantee cost will be 0.50% of the outstanding loan amount, which will be borne by the bank.

- The guarantee would cover 75% of the amount by default.

Indian Bank Education Loan – Insurance

For students receiving an educational loan, a life insurance policy is essential for the loan limit sanctioned, covering the whole loan duration, including the study period, holiday/moratorium period, and repayment period.

It can be done under the group life insurance policy, i.e., New IB Jeevan Vidya (provided by LIC), IB Vidyarthi Suraksha (issued by PNB Met Life), or under any other policy, as preferred by the student borrowers. The policy premium may be regarded as an element that can be financed.

Indian Bank Education Loan – Courses Pursued

If a course being pursued is partially finished in India and partially abroad, and the university in India issues a graduation certificate, the loan account must be set up under the ‘Studies in India’ component. However, the account will not be eligible for subsidies under the Central Sector Interest Subsidy (CSIS) Scheme. If a foreign university issues a graduation certificate, the loan account should be set up under the ‘Studies Abroad’ segment.

Indian Bank Education Loan – Transfer and Takeover of Education Loan

The students from premier elite and premier special institutes are allowed to transfer their education loans from any bank or financial institution, provided they meet the following eligibility criteria:

- Transfer of education loan can be done at any time during the loan period, including the course duration, moratorium, and repayment period, as long as the guidelines for sanctioning education loans for these institutes are followed.

- The applicants must be enrolled as regular students in their current course or studies.

All other terms and conditions, including security requirements and the rate of interest, will be applicable based on the category of the college as defined in the education loan circular.

Indian Bank Education Loan – Application Process

The students can apply for Indian Bank’s education loan online via the official website or offline through a branch. The procedure for applying online is as follows:

- Visit the official loan website.

- Scroll down and click on ‘Apply for loan (Click Here)’.

For existing customers of the Indian Bank:

- Click the option ‘Yes’ and enter your account number, then click ‘Generate OTP’.

- The applicants will receive an OTP on the registered mobile number or email ID.

- Enter the OTP and click on the ‘Submit’ button.

- Now, fill in the required details.

- The applicants will receive a call from the bank agent regarding the IB Education Loan.

For non-existing customers of the Indian Bank:

- Click the option ‘No’ and enter your mobile number, then click ‘Generate OTP’.

- The applicants will receive an OTP on the provided mobile number.

- Enter the OTP and click on ‘Submit’ to verify the OTP.

- Fill in the required fields with the necessary information.

- Select ‘I permit the bank to reach me by phone number or email’ and choose a preferred time of contact (morning, afternoon, or evening).

- Click on ‘Submit’.

- The applicants will receive a call from the bank agent regarding the IB Education Loan.

For applying offline, the applicants can visit a nearby branch with the required original documents and their scanned copies and request an education loan application form. Fill the form with correct information and submit it along with the documentation to the bank representative.

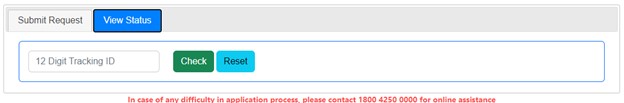

Indian Bank Education Loan – Checking Application Status

Once the application form is complete, the applicant will be provided with a 12-digit tracking ID. To check the status of the application, adhere to the following steps:

- Visit the official loan website and click on the option to apply.

- Click the ‘View Status’ tab.

- Enter the 12-digit tracking ID and click on ‘Check’.

Also Read: HDFC Bank Parivartan’s ECSS Programme 2024-25 – Inspiring Success, Impacting Communities

Indian Bank Education Loan – FAQs

How many types of education loans are available to Indian students?

The students in India can choose to apply for education loans on offer under domestic, overseas or skill development loan schemes categories.

Is insurance mandatory for availing an education loan from the Indian Bank?

Yes, the borrowers must get a life insurance policy before applying for an education loan.

Who can apply for the Indian Bank Education Loan?

The students hailing from any community or section of the Indian society can apply for an education loan. There are no caste, community, age, or gender-related barriers.

How is the Equated Monthly Installment (EMI) calculated for an education loan?

Equated Monthly Installments (EMIs) are calculated on the basis of principal loan amount, applicable interest rate, and repayment tenure. The banks often provide EMI calculators on their websites to help borrowers plan their repayments.

What is a collateral-free loan?

A collateral-free loan is a type of loan where the borrower doesn’t have to pledge any assets as security. It is also known as an unsecured loan. The lenders base their decisions on the borrower’s creditworthiness and financial health.

What is a moratorium period?

The moratorium period is a specified time in which borrowers are not required to make regular repayments for the availed loan amount. Usually, it is the course duration plus 1 year after completion of the course.

What is a Repo Rate?

We all borrow money from commercial banks by taking loans at a certain interest rate. Similarly, banks borrow money from the Central Bank i.e. the RBI at a certain interest rate. The repo rate is the rate of interest at which the commercial banks borrow money from RBI against government securities.

What is a Repo Based Lending Rate (RBLR)?

Repo-based lending rate (RBLR) is dependent on the existing repo rate, which is the interest rate at which the central bank (RBI) of a country lends money to commercial banks. The Reserve Bank of India (RBI) uses the repo rate to regulate liquidity i.e. money flow in the economy and this forms the basis of the repo-based lending rate (RBLR) applicable for all commercial banks in India.

What is a Base Rate?

Base Rate is nothing but a benchmark below which the lenders i.e. banks and financial institutions are not allowed to lend money to their customers.

What is a margin or spread of interest rates?

A spread/margin of interest rates can be understood in a simple manner. A bank charges a certain amount as interest from the borrower and it pays a certain amount as interest to the depositor. The difference between these two interest rates is called bank spread or margin.